Biden kicks off student loan relief application season

4 min read

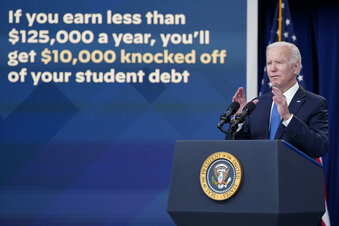

President Joe Biden speaks about the student debt relief portal beta test in the South Court Auditorium on the White House complex in Washington, Monday, Oct. 17, 2022. (AP Photo/Susan Walsh)

WASHINGTON (AP) — President Joe Biden on Monday officially kicked off the application process for his student debt cancellation program and announced that 8 million borrowers had already applied for loan relief during the federal government’s soft launch period over the weekend.

He encouraged the tens of millions eligible for potential relief to visit studentaid.gov and touted the application form that the president said would take less than five minutes to complete. An early, “beta launch” version of the online form released late Friday handled the early stream of applications “without a glitch or any difficulty,” Biden said.

“It means more than 8 million Americans are — starting this week — on their way to receiving life-changing relief,” Biden, accompanied by Education Secretary Miguel Cardona, said Monday. The president called his program a “game-changer” for millions of Americans saddled with student loan debt.

The number of borrowers who applied during the testing period already amounts to more than one-fourth of the total number of applicants the administration had projected would submit forms, underscoring the popularity of the program and the eagerness of borrowers to receive the debt relief. Some 8 million borrowers who have income information already on file with the Education Department would see their debt canceled without applying.

Biden’s plan calls for $10,000 in federal student debt cancellation for those with incomes below $125,000 a year, or households that make less than $250,000 a year. Those who received federal Pell Grants to attend college are eligible for an additional $10,000. The plan makes 20 million eligible to get their federal student debt erased entirely.

Biden promised to pursue widespread student debt forgiveness as a presidential candidate, but the issue went through more than a year of internal deliberation amid questions about its legality. His plan sparked intense debate ahead of the midterm elections, with Republicans and some Democrats saying it’s an unfair handout for college graduates.

But on Monday, Biden offered a full-throated defense of his decision.

“My commitment was if elected president, I was going to make government work to deliver for the people,” Biden said. “This rollout keeps that commitment.”

He also took aim at Republican officials who have either criticized the plan or are working in court to defeat it.

“Their outrage is wrong and it’s hypocritical,” Biden said. “I will never apologize for helping working Americans and middle class people as they recover from the pandemic.

Biden on Monday said the White House has received more than 10,000 comments and calls of thanks from borrowers. Indeed, thousands took to social media to share the form, with many saying they submitted their applications with little trouble.

The Biden administration has touted it as a “simple, straightforward” application. It asks for the borrower’s name, Social Security number, contact information and date of birth. It does not require income information but asks users to check a box attesting that they are eligible under the program’s income limits.

That information will be checked against Education Department records to help identify applicants who are likely to exceed the income limits, the administration says. Those people will be asked for more information to prove their incomes.

An estimated 1 million to 5 million people will be required to provide that extra documentation, the Education Department said in a recent submission to the White House’s Office of Management and Budget.

Creating and processing the form is estimated to cost nearly $100 million, a figure that angered advocates who view the application as an unnecessary barrier. The form is meant to help exclude the roughly 5% of borrowers who exceed the income limits, but advocates say it could also deter some lower-income Americans who need the relief.

Once the Education Department begins processing applications, borrowers should expect to see their debt forgiven in four to six weeks, officials say. Most applications submitted by mid-November will be processed by Jan. 1 — the day federal student loan payments are set to resume after being paused during the pandemic.

Borrowers will be able to submit applications through the end of 2023.

The Biden administration is pushing ahead with the debt cancellation even as it fights a growing number of legal challenges. Six Republican-led states are suing to block the plan, saying it oversteps Biden’s authority and will lead to financial losses for student loan servicers, which are hired to manage federal student loans and earn revenue on the interest.

A federal judge in St. Louis is now weighing the states’ request for an injunction to halt the plan. In court documents, the Education Department has vowed not to finalize any of the debt cancellation before Oct. 23.

Biden acknowledged Monday that litigation is ongoing but said his administration believes the lawsuits won’t ultimately affect the program.